A Quick Refresher on the SSL Saga Timeline

Origins: From Paul Chen-Young & Co. to SSL

The company now known as Stocks & Securities Limited (SSL) was the second oldest brokerage firm in Jamaica. It started in 1977 as Paul Chen-Young & Company, named after its founder, late economist Dr. Paul Chen-Young, who also founded the Eagle Group. The company entered the stock-broking business in the 1970s and was later renamed SSL in 2006 following an ownership change.

Over time, SSL became one of Jamaica’s better-known brokerage and investment firms, handling wealth management and securities for hundreds of clients.

Early Warning Signs: Years of Flags and Mismanagement

Long before the scandal broke in 2023, regulators were raising concerns.

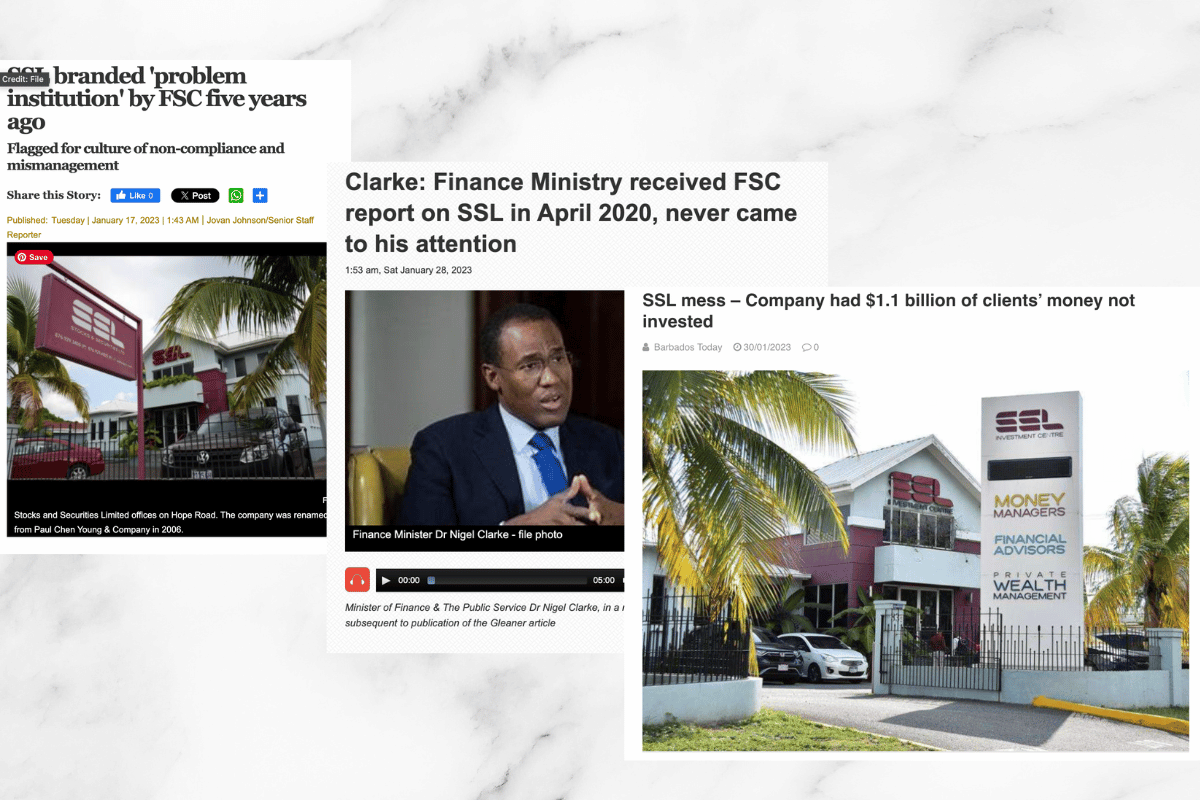

As early as 2017, Jamaica’s Financial Services Commission (FSC) labeled SSL a “problem institution” because of a culture of non-compliance and mismanagement of client funds. The firm repeatedly failed to file audited accounts on time, violated regulatory directives, and showed weak internal controls.

These reflected systemic weaknesses in the way SSL was run and overseen, raising questions about governance and financial oversight going back years.

There were also connections between SSL’s leadership and earlier local financial ventures. SSL founder Hugh Croskery had ties with figures from the failed Eagle financial empire, further raising concerns about governance culture.

Read:

Early 2023 - The Fraud Comes to Light

The story erupted publicly in January 2023, after major discrepancies were found in several client accounts, most notably the account of sprint legend Usain Bolt, whose funds were reported missing or mishandled.

Regulators swiftly moved in: the FSC placed SSL under temporary management, appointing a special auditor to try to stabilise the situation and prevent more harm.

Investigations revealed a multi-billion-dollar fraud affecting hundreds of accounts, with losses for dozens of investors. Government and financial authorities later estimated the extent of the irregularities in the billions of Jamaican dollars (and many millions of U.S. dollars).

The case triggered public outrage because it involved regular clients and high-profile figures with long-held trust in SSL’s operations.

Read:

Long Probe and Public Frustration

What followed was one of the most complex financial investigations in Jamaica’s history. The Financial Investigation Division (FID) and other agencies combed through years of transactions, client records, and financial flows because the alleged wrongdoing involved decades of operations.

The public grew frustrated with the pace of progress. Victims, including Bolt, pressed for answers and accountability as the probe stretched into 2024 and 2025. The authorities defended the slow pace, explaining that the sheer volume of data and its complexity required meticulous work.

Read:

Late 2025 - Turning Point

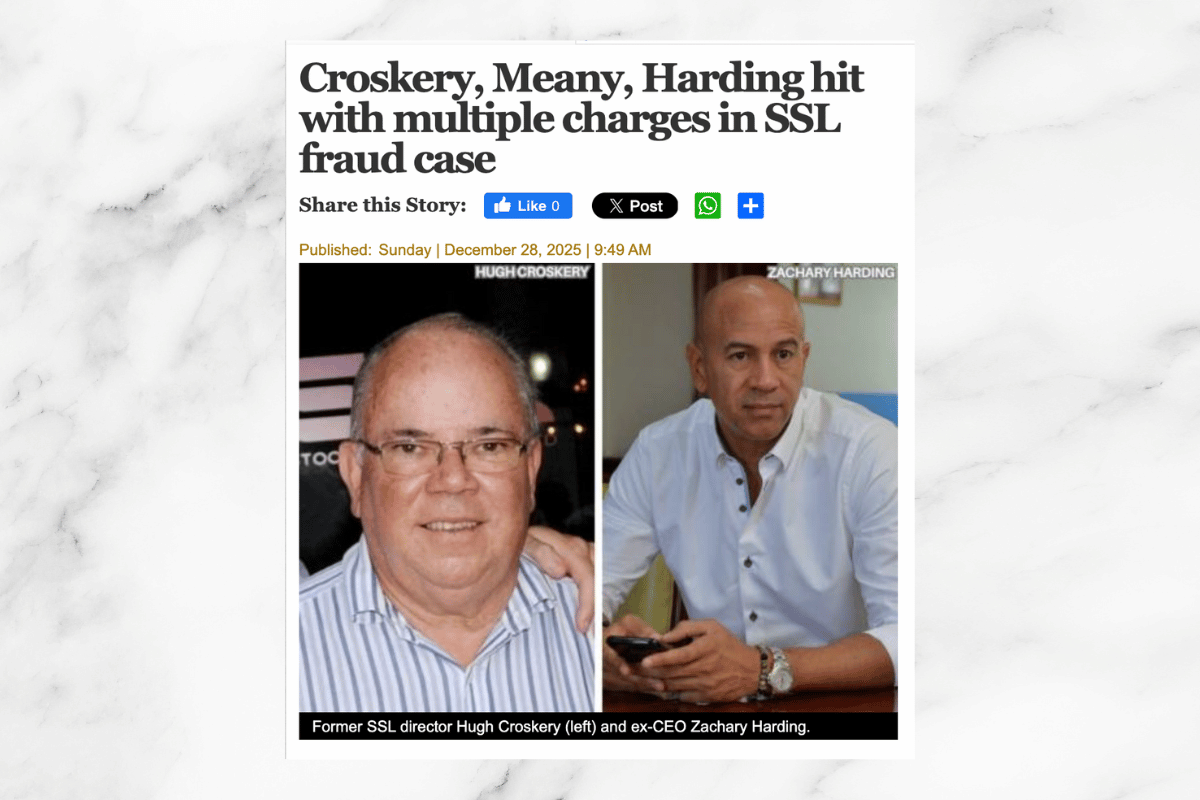

After nearly three years of investigation, criminal charges were finally laid against three former SSL leaders: Hugh Croskery, founding director of SSL, his daughter Sarah Meany and former chief executive from 2019 - 2022, Zachary Harding.

They face a range of charges, including:

• Fraudulently inducing persons to invest

• Operating without proper licences

• Failure to register companies properly

• Breaches of securities, banking and company law

Read:

Responses and Next Steps

After their arrests and charges, all three were granted bail and are expected to appear in court in early 2026. Harding has publicly denied wrongdoing and insists that he cooperated with regulators during his tenure, claiming no role in any misappropriation of client funds.

The case now moves into the courtroom and will likely involve detailed legal battles over evidence, responsibility and accountability.